Solar Relief Path Under Rising Factory Energy Costs

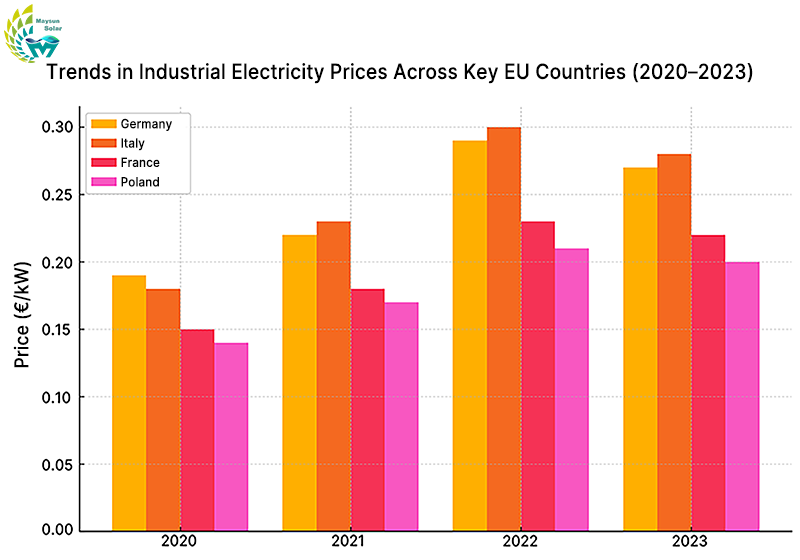

Electricity prices are no longer a “cost variable” for factories—they have become a structural risk that directly affects competitiveness. Over the past three years, industrial electricity prices in Europe have continued to rise. According to Eurostat data, from 2020 to 2023, medium-voltage electricity prices in several member states increased by over 40%. In industrial hubs like Germany, Italy, and Belgium, prices have remained high at €0.25–0.35/kWh, well above historical baselines for corporate electricity use.

Manufacturing and other factory-based enterprises, which are highly dependent on energy, face two major challenges:

Soaring energy procurement costs are eroding profit margins.

Heavy reliance on external energy markets makes it difficult to hedge against geopolitical risks and electricity price fluctuations.

As the coverage of the EU Emissions Trading System (EU ETS) continues to expand, energy structures have become closely tied to corporate compliance costs, further squeezing the profit margins of companies reliant on traditional energy. In this context, commercial and industrial solar—an exemplary distributed energy solution—is becoming a vital tool for manufacturers to control electricity costs. Compared to centralized power generation, commercial solar offers proximity to the load, reduced transmission losses, and self-contained returns. It is particularly suitable for industrial settings with large available rooftop space and stable electricity demand.

Commercial and industrial solar transforms the traditionally “fully outsourced” energy expenditure into energy assets owned by the company. Over an operating cycle of more than 20 years, factories gain access to stable, predictable, and low marginal cost clean electricity. This significantly reduces the levelized cost of electricity (LCOE) and mitigates the risks of electricity price volatility. In addition, the EU and several national governments are accelerating the deployment of commercial solar systems through tools such as green tax credits, low-interest financing, and simplified grid connection procedures—further increasing solar coverage in the manufacturing sector.

With persistent energy inflation and visible carbon costs, the role of solar in manufacturing is shifting from a symbolic green gesture to a practical tool for improving profit stability and optimizing the energy structure.

How Solar Transforms the Electricity Structure and Cost Model of Factories

For most factories, relying on the public power grid has long been the standard electricity supply structure. This leads to energy costs being affected by external electricity rates and peak-valley pricing. In today’s environment of continuously rising electricity prices, a fully outsourced and passive electricity model has become a key factor impacting factory profitability and strategic stability. At this point, commercial and industrial solar offers factories a power structure that is “partially self-owned, diversified, and with stable marginal costs.”

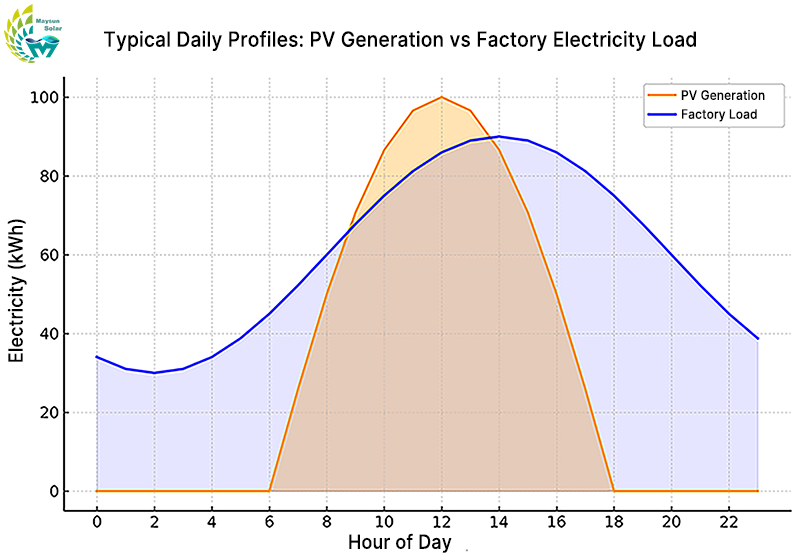

1. High Match Between Generation and Consumption Curves – Ideal for Self-Consumption Mode

Factories typically reach their peak electricity usage during daytime hours (8:00–18:00), which naturally aligns with the solar power generation period. The electricity generated by solar systems can be directly consumed by production lines, compressors, lighting systems, and other loads, reducing dependence on grid electricity. Through the self-consumption model, solar effectively covers the most stable and costly portion of factory energy use, helping control operational expenses.

2. Significant Electricity Cost Reduction – Long-Term Price Difference Brings Direct Savings

Compared to current grid electricity prices of €0.18–0.25/kWh, the levelized cost of electricity (LCOE) for commercial and industrial solar typically falls between €0.06–0.08/kWh, creating a substantial price gap. For a medium-sized factory, installing a 300kW–500kW solar system on idle rooftops can generate 280,000–550,000 kWh annually (depending on local sunlight resources). With a self-consumption rate of 70%, this could save €30,000–€60,000 in electricity costs per year. The typical payback period is 5–7 years, and in high electricity price regions, it can be shortened to less than 4 years—well below the system’s lifespan (≥25 years). When combined with government subsidies, carbon credit revenues, and green financing, the financial return period can be further shortened.

3. Locking in Electricity Prices – Hedging Against Price Volatility

As an asset-based energy configuration, solar power allows for long-term electricity price locking, helping factories guard against wholesale price increases and energy tax fluctuations. In a volatile energy market, this “price lock” mechanism supports financial stability and budget predictability.

4. Integration into Asset Structure – Enhancing Financial and ESG Value

A solar system can be recorded as a fixed asset in the factory’s asset structure, eligible for depreciation and benefiting from green financing advantages. As a green asset, it also improves a factory’s performance in ESG ratings, financing access, and supply chain assessments—making it a strategic configuration for sustainable corporate development.

From Self-Investment to Rooftop Leasing Mainstream Models for Solar Deployment in Factories

As commercial and industrial solar gains visibility among factories and manufacturing enterprises, a variety of deployment models have emerged to meet different business needs. All of these models share a single goal—to help companies reduce electricity costs and manage price volatility.

1. Self-Invested and Self-Owned Full Control with High Capital Commitment

In this model, the factory funds the construction of the solar system and owns all assets and returns. The electricity generated can be used for self-consumption or sold to the grid, offering relatively high returns. This approach is suitable for large factories with strong cash flow and long-term energy strategies. However, it requires substantial upfront investment, technical management capabilities, and navigation of project approval processes, which often presents challenges for small and medium-sized factories.

2. Power Purchase Agreement (PPA) Delegated Operation with Long-Term Fixed Pricing

Under the PPA model, a third party is responsible for investment, construction, and operation, while the factory signs a long-term electricity purchase agreement to receive solar power at a fixed price lower than grid electricity. This solution enables “zero asset electricity use” and reduces initial financial pressure. It suits factories with stable electricity demand and long-term planning capacity. However, PPAs often involve long contract periods (typically 10–20 years), complex terms, limited flexibility, and sensitivity to grid regulations and legal environments.

3. Rooftop Solar Leasing Zero-Capital Light Asset Deployment

Rooftop solar leasing is currently one of the fastest-growing and most adaptable commercial solar deployment models.

In this model, the factory leases its rooftop to a third-party solar investor, who provides full funding and system maintenance. The factory gains stable rental income or enjoys a portion of low-cost electricity under the agreement. This model requires no upfront investment, does not add to fixed assets, and carries low risk.

Compared to other options, rooftop solar leasing offers zero investment, zero burden, and rapid deployment. It is particularly suitable for small and medium-sized factories with limited capital, no dedicated energy teams, or no long-term energy investment plans. Against the backdrop of carbon neutrality policies, green supply chain requirements, and expanding sustainable financing mechanisms, rooftop solar leasing is becoming the practical first step for many factories toward optimizing their energy structure.

For example, Maysun Solar, as a solar investor and manufacturer, has partnered with factories across Europe to implement zero-investment rooftop solar leasing programs, providing integrated services from module supply to project construction. This helps companies reduce electricity costs and enhance competitiveness—without any initial capital outlay.

The Starting Point of Factory Energy Transition Building Sustainable Competitiveness with Solar

Amid rising energy costs and increasingly stringent green policies, energy has evolved from a single cost component into a strategic factor affecting factory profit structures and industrial adaptability. Due to its high predictability, low marginal cost, and minimal maintenance burden, commercial and industrial solar is becoming a crucial tool for factories to optimize energy use and improve efficiency while reducing costs.

Deploying commercial solar is not only about saving on electricity bills—it also represents a proactive adjustment of the enterprise’s energy structure. For energy-intensive factories, owning part of their solar power generation can significantly reduce peak electricity purchase costs, lessen dependence on grid fluctuations, and enhance market competitiveness.

Integrating solar systems into the asset structure enables companies to optimize their financial framework through depreciation, green loans, and carbon credit mechanisms, thereby improving risk resilience. At the same time, with ESG requirements and green supply chain standards rising, renewable energy capabilities are gradually becoming essential for manufacturers to maintain market access and strengthen brand competitiveness.

Thanks to its flexible deployment, predictable returns, and clear policy support, commercial and industrial solar is becoming the preferred solution for an increasing number of factories starting their energy optimization journey. It not only rapidly reduces electricity costs but also lays the foundation for building long-term sustainable capabilities.

Since 2008, Maysun Solar has been both an investor and manufacturer in the photovoltaic industry, providing zero-investment commercial and industrial rooftop solar solutions. With 17 years in the European market and 1.1 GW of installed capacity, we offer fully financed solar projects, allowing businesses to monetize rooftops and reduce energy costs with no upfront investment. Our advanced IBC, HJT and TOPCon panels, and balcony solar stations, ensure high efficiency, durability, and long-term reliability. Maysun Solar handles all approvals, installation, and maintenance, ensuring a seamless, risk-free transition to solar energy while delivering stable returns.

References

Eurostat. (2023). Electricity prices for non-household consumers – bi-annual data (from 2007 onwards). https://ec.europa.eu/eurostat

IEA. (2022). Renewables 2022 – Analysis and forecast to 2027. https://www.iea.org/reports/renewables-2022

SolarPower Europe. (2023). EU Market Outlook for Solar Power 2023–2027. https://www.solarpowereurope.org

You may also like:

Which solar modules perform better under high summer temperatures?

Can high summer temperatures reduce the power generation efficiency of solar modules? This article compares the performance of HJT, TOPCon, and IBC modules under high temperatures to help you make informed choices and optimize your return on investment.

Structural Risks and Component Adaptation Strategies for Commercial PV Deployment under Extreme Weather Conditions

A comprehensive analysis of the structural risks and component configuration strategies for commercial and industrial PV systems under extreme weather conditions, helping businesses enhance system stability and long-term energy yield.

How Can Photovoltaics Help Businesses Cut Peak Electricity Costs During Summer Price Spikes?

How Can Businesses Use Photovoltaic Systems to Address Summer Electricity Price Peaks? This article provides cost-saving calculations, suitability conditions, and technical selection recommendations.

How to Detect Hotspots and PID Effects in PV Modules to Prevent Long-Term Losses?

How to identify and respond to hotspots and PID effects in PV modules? This article focuses on the European market, combining detection technologies, real-world cases, and protection strategies to provide developers and investors with reliable loss warnings and yield protection solutions.

How to Choose the Most Suitable Solar Panels for Commercial and Industrial Use in 2025

How can commercial and industrial projects choose the right solar panels in 2025?

This article provides a systematic comparison of mainstream panel types such as TOPCon, HJT, and IBC, analyzing their advantages, disadvantages, and suitable applications. It aims to help businesses make accurate selections based on specific project conditions, thereby improving long-term energy output and return on investment.

After the Iberian Blackout How Can Enterprises Reshape Their Energy Security Systems

The 2025 Iberian blackout drew widespread attention across Europe. This article analyzes grid vulnerability, enterprise energy risks, and the deployment path of “solar + storage + EMS” systems to help businesses build a controllable and secure energy structure.

It’s eye-opening to see how rapidly industrial electricity prices have increased across Europe. Leveraging solar energy as a long-term strategy feels not just smart, but essential for maintaining competitiveness in manufacturing.