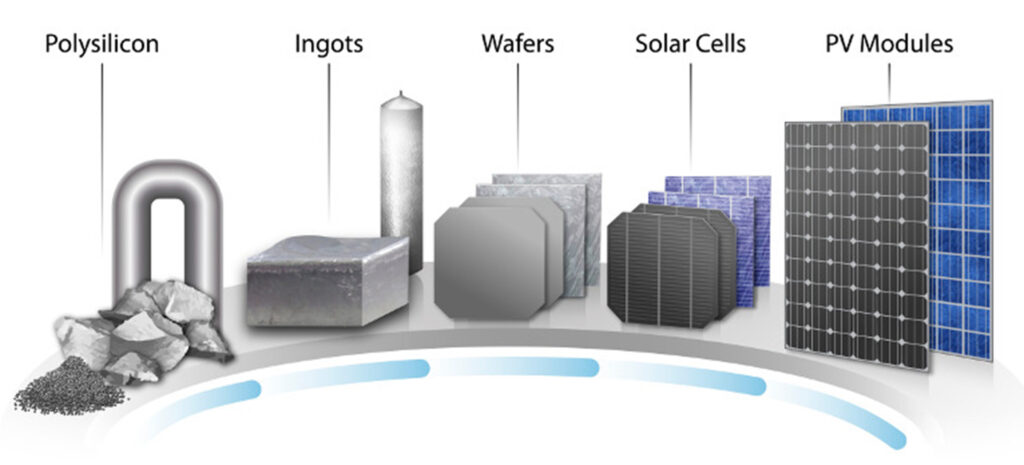

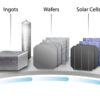

Silicon prices

Last week, with the rising start-up rate of downstream silicon wafer enterprises and the continuous release of new production capacity, the supply of silicon material continued to be tight. This week, the mainstream quotation of monocrystalline silicon material came to RMB205-215/KG, with some bulk orders trading at relatively higher prices driven by demand.

Observe the production operation and shipment of silicon links, China’s twelve silicon enterprises in production, including Jiangsu Zhongneng recent maintenance of self-provided power plants, affecting part of the output. By the downstream production cuts in the early stages and the current actual demand of the terminal to pull the influence, silicon procurement orders are positive, including the direct purchase of silicon by downstream enterprises after silicon wafer foundry, further causing silicon supply tension. According to feedback from silicon enterprises, the price of silicon raw materials has also been on an upward trend recently due to the impact of China’s environmental protection and energy consumption control policies, especially the price of silicon powder market has increased significantly. The upward adjustment of costs and the increase in downstream demand have contributed to a certain upside in silicon prices.

Silicon wafer prices

Wafer prices continued to rise this week, with polycrystalline prices rising at a relatively higher rate. Since the middle of the year, the upstream trend has become more rational, and the rise in monocrystalline silicon wafers was slightly smaller. As terminal demand rises, cell companies increase their procurement needs, making wafer shipments continue to increase, the head of the wafer companies to enhance silicon procurement and improve the start-up rate, resulting in other companies silicon output is limited, especially the supply of large-size products resources slightly nervous. After nearly two weeks of the market adjustment up signal release, downstream successively accepted, orders gradually landed.

With the pull of overseas demand, the recent polycrystalline silicon wafer orders increased significantly, and due to the limited polycrystalline production capacity in the market, silicon wafer bargaining power concentrated in the hands of a few enterprises, to promote this week on the polycrystalline market at home and abroad silicon wafer prices further up to 2.35 yuan / piece and 0.321 U.S. dollars / piece.

Solar cell prices

This week, cell prices remained stable at a high level, with low-priced resources clearing one after another. Upstream raw materials such as silicon and wafer prices were affected by the continuous upward trend, giving some impetus to the upward adjustment of cell prices. Monocrystalline cells, due to the cell competition pattern relative to the upstream more fragmented, coupled with the continued pressure on the battery side of the component companies, monocrystalline battery prices since the end of August slowed down relatively, not up to the previous high point. At present, the downstream acceptance is significantly lower, some enterprises and downstream enterprises of the game is obvious.

Polycrystalline batteries, due to the upstream polycrystalline products rose significantly, the price of polycrystalline batteries also pulled, low-priced resources are very difficult to find, the overall offer in more than 0.8 yuan / W.

Photovoltaic module prices

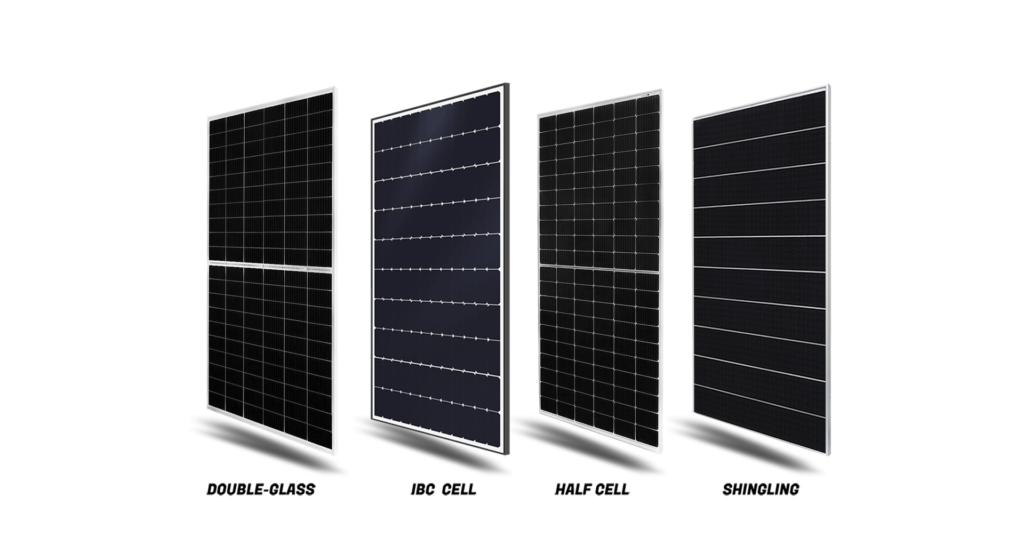

This week’s module prices were slightly adjusted upwards due to cost pressure. With the adjustment of upstream industry chain prices, component companies had to respond by adjusting upwards. The price of M6 monocrystalline PERC modules rose to around 1.78 Yuan/W Yuan, and the mainstream price of M10 and G12 monocrystalline PERC modules rose back to 1.8 Yuan/W. Based on the current limited affordability of the terminal, the overall terminal acceptance is low, and only some of the rigid demand has been conceded. At present, only a small part of the order landing deal, the other is still in the game stage, some small and medium-sized component enterprises by the cost of pressure multiplied.

This week, the glass purchase orders have landed, the thickness of the glass offer has been raised. Following last week’s market up signal, this week’s orders have landed, due to the impact of soda ash, natural gas prices, photovoltaic glass costs have risen, to promote the glass business quotes up, but some of the first-line enterprises in the face of old customer orders, price increases are more difficult. Currently 3.2mm thickness of photovoltaic glass prices at 24-28 yuan / ㎡, 2.0mm thickness of photovoltaic glass prices at about 20-22 yuan / ㎡.

This week’s forecast

This week’s PV price trend: silicon wafers continue to slowly rise, downstream acceptance to reduce the game obvious, material prices to the current situation will not have a substantial increase for the time being, but the end of the component prices are still at a low level, component prices continue to rise this week is more likely.

Following such confusing times, people often find themselves locked up in a dilemma on the decision of installing the appropriate PV module for their homes, offices, etc. And for that very reason, we are here ready to assist you in whatever you need. Contact us now at Whatsapp: +86 159 2091 1832 and get a quote.