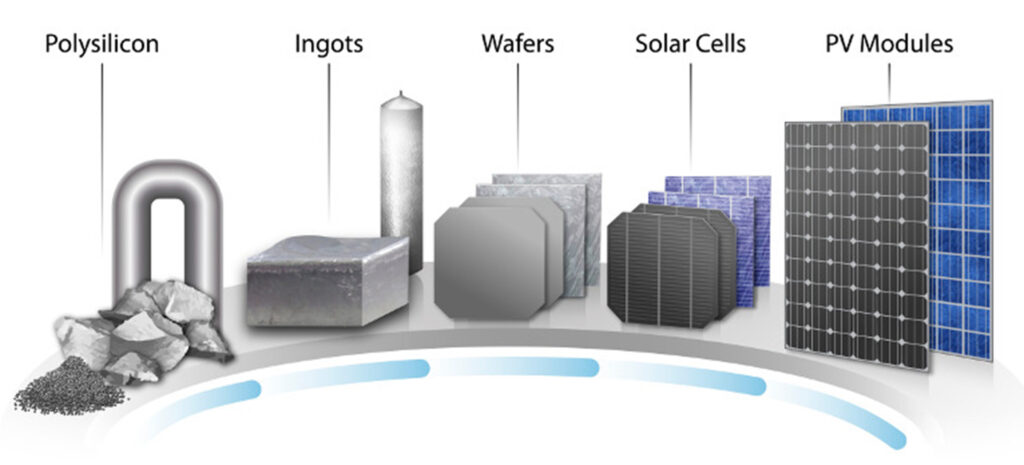

Solar silicon material: Prices continued to rise, with a small increase. The overall single crystal quotation this week is around USD 38.8/KG.

In the case of expected demand and rising prices, solar silicon wafer companies still have strong demand for solar silicon materials. Some solar silicon material companies have basically completed long-term orders in March. Due to the current shortage of supply, there were also a small number of orders in April. Mainstream prices remained basically stable, while the prices of some scattered orders increased.

Observing the production operation and shipment situation of the silicon material link, there are 13 domestic polysilicon companies producing polysilicon, one of which is undergoing maintenance in a separate line, and two overseas material companies are affected by factors such as maintenance and shipping. It is estimated that the import volume of solar silicon materials in March will decline. It is expected that in late March, as most of the long-term orders for solar silicon materials have been signed, there is not much remaining available for sale in the market, and the transaction prices of some urgent orders will increase, and the price of solar silicon materials will maintain a stable upward trend.

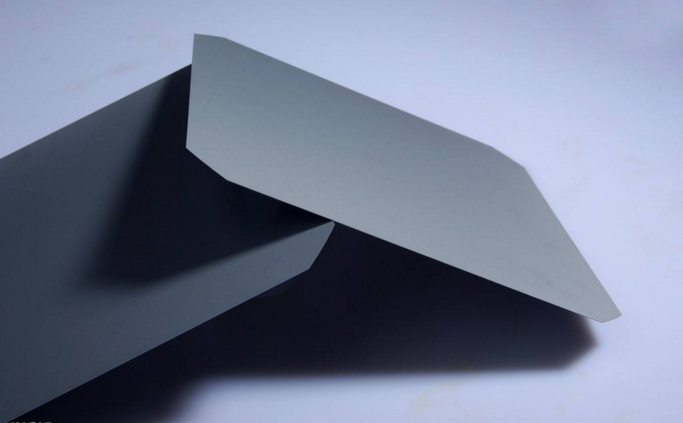

Solar silicon wafers: The prices of solar silicon wafers of all sizes have risen, and the 182MM solar silicon wafer has the largest increase.

Recently, LONGi once again announced an increase in the price of solar silicon wafers. Compared with the quotation of the previous month (February 22), the 182MM size solar silicon wafers increased by USD0.03/W, an increase of 3.08%. Most solar silicon wafer companies also increased their prices. After the price increase, the market transaction is still relatively smooth. This week, the mainstream transaction price of M6 rose to about USD0.86/piece, the mainstream transaction price of M10 increased by 2.15% to about USD1.04/piece, and the mainstream transaction price of G12 rose to about USD1.38/piece. After the end of the year, there will be continuous demand from the terminal, and the market’s purchase of solar silicon wafers and solar cells has not slowed down. There is a phenomenon of “grabbing” solar cell companies. The wafer enterprises resumed operation, and the output gradually increased. The supply of superimposed solar silicon materials is limited, the output is limited, the supply is in short supply, and the price is supported. It is expected that there is still room for the price of solar silicon wafers to rise in the short term.

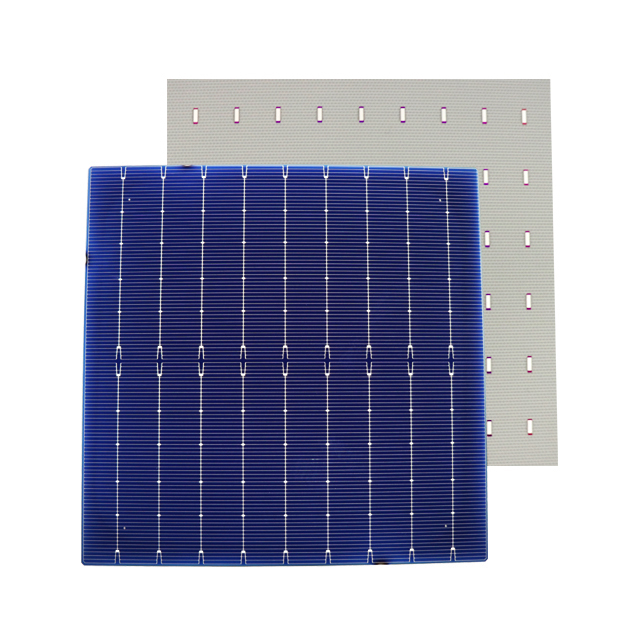

Solar Cells: Prices Slightly Increased

This week, the mainstream transaction price of monocrystalline M6 solar cells was around USD0.17/W, the mainstream transaction price of M10 solar cells rose to around USD0.18/W, an increase of about 1.79%, and the mainstream transaction price of G12 solar cells was USD0. 18/W or so. After Tongwei raised the price of solar cells last week, Tongwei continued to increase the price of solar cells this week. The latest quotation of mono PERC 182 cells was USD0.18/W, an increase of USD0.002/W; the latest quotation of mono PERC 210 cells was USD0. 16 yuan/W, up USD0.003/W. With the gradual launch of projects such as the installation of domestic wind and solar power bases, the demand for solar cells and photovoltaic modules for stocking continues. In March, new orders began to be negotiated one after another. wait-and-see attitude.

Photovoltaic modules: prices remain stable overall

The mainstream transaction price of monocrystalline 166MM photovoltaic modules is around USD0.29/W, the mainstream transaction price of monocrystalline 182MM photovoltaic modules is around USD0.3/W, and the mainstream transaction price of monocrystalline 210MM photovoltaic modules is around USD0.3/W. The 2022 government work report points out that it is necessary to promote the carbon neutralization work in an orderly manner, promote the low-carbon transformation of energy, promote the planning and construction of large-scale wind and photovoltaic bases and their supporting regulated power sources, and improve the grid’s ability to absorb renewable energy power generation. . Recently, projects such as the installation of large-scale domestic wind and solar bases have been gradually launched, increasing the demand for photovoltaic modules. Although there are signs of decline in overseas demand, it is expected that the demand will continue until the end of March. At present, due to the increase in the prices of raw materials and auxiliary materials in the industrial chain, the cost of photovoltaic modules has risen, and the profit margin has been further reduced. Considering the acceptance of terminal project operators, it is difficult for the price of modules to increase significantly.

In terms of auxiliary materials, the price of glass was basically stable this week. The mainstream transaction price of glass with a thickness of 3.2mm this week was about USD4.25/㎡, and the mainstream transaction price of glass with a thickness of 2.0mm was about USD3.3/㎡. Photovoltaic glass has also continued to develop steadily under the relatively stable quotation of modules recently.

Next week forecast

It is expected that the price of photovoltaic modules will continue to be stable next week, but the possibility of a slow increase is not ruled out. It is hoped that customers with projects will stock up as soon as possible to reduce the cost loss caused by the continued price increase.

Following such confusing times, people often find themselves locked up in a dilemma on the decision of installing the appropriate PV module for their homes, offices, etc. And for that very reason, we are here ready to assist you in whatever you need. Contact us now at Whatsapp: +86 159 2091 1832 and get a quote.