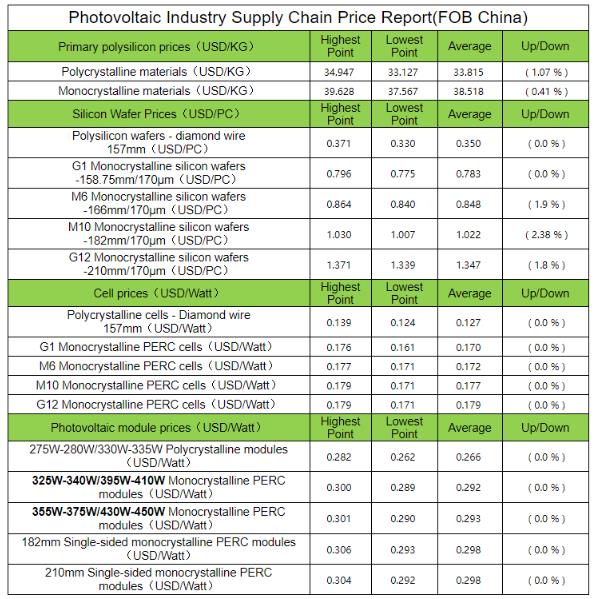

Solar silicon material: The price continues to rise, and the increase becomes smaller. The overall mono price this week is around USD 38.5/KG.

Near the end of February, some solar silicon material companies began to talk about orders in March. It is expected that the production of solar silicon materials in March will not meet expectations due to the production line maintenance and expansion of production capacity. The rate will increase, the demand for solar silicon materials will increase, the gap between supply and demand still exists, and the prices of long-term orders and bulk orders have increased to varying degrees.

Observe the production, operation and shipment of solar silicon materials. This week, 13 solar silicon materials companies in China are in production, and one of them has not completed the line maintenance. There is also a solar silicon material company overseas which is undergoing line maintenance. volume has decreased. It is expected that the long-term orders in March will be signed in nearly two weeks, and the solar silicon material will always be at a high price in March.

Solar wafers: Prices rose slightly, with M10 rising the most.

Recently, LONGi announced a new round of quotations. Compared with the last quotation, the price of solar silicon wafers of different sizes increased by USD 0.0475~0.0554/PC, an increase of 5.7~6.1%. . This week, the mainstream transaction price of M6 rose to around USD 0.847/PC, the mainstream transaction price of M10 increased by 2.38% to around USD 1.02/PC, and the mainstream transaction price of G12 rose to around USD 1.346/PC. The end market demand is strong, and the operating rate of downstream solar cell companies has increased, driving the demand for solar silicon wafers. The output of solar silicon wafers is affected by the insufficient supply of solar silicon materials and the production cycle of production lines after the operating rate has increased, resulting in limited output and tight supply. At present, the operating rate of first-tier enterprises has increased to about 75%, and the operating rate of integrated enterprises has also remained at 80%-100%. If the terminal demand continues to increase, the utilization rate is expected to increase further.

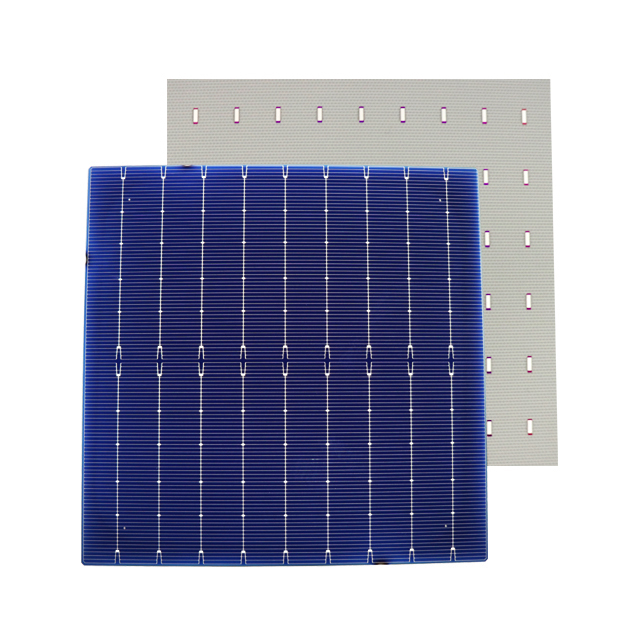

Solar cells: prices remain stable overall

The mainstream transaction price of M6 solar cells this week is around USD 0.172/W, the mainstream transaction price of M10 solar cells is around USD 0.177/W, and the mainstream transaction price of G12 solar cells is around USD 0.179/W. The terminal demand is very hot for solar cell orders, and some solar cell companies have been trying to adjust their quotations. Photovoltaic module companies still have stocks in stock in the previous year and do not accept the increase in prices. Moreover, the recent photovoltaic module quotations have been stable, and there is not much room for solar cell quotations to increase. In addition, the price of upstream solar silicon wafers continues to rise, and the profitability of solar cell companies is relatively low.

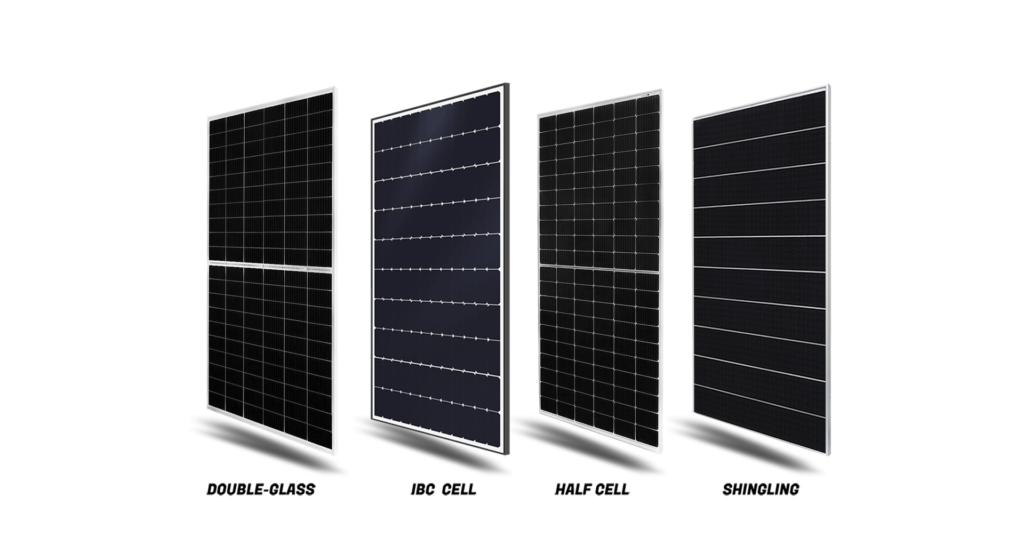

Photovoltaic modules:

Prices remain stable. The mainstream transaction price of monocrystalline 166MM photovoltaic modules is around USD 0.293/W, the mainstream transaction price of monocrystalline 182MM photovoltaic modules is around USD 0.297/W, and the mainstream transaction price of monocrystalline 210MM photovoltaic modules is around USD0.297/W.

On February 21, Huadian Group opened bids for the procurement of photovoltaic modules and inverter frameworks in 2022. The highest bid opening price was USD 0.302/W, the lowest price was USD 0.286/W, and the average quotation was USD 0.294/W. At present, the overseas rush for equipment delivery is nearing the end, and China’s domestic large-scale base projects continue to advance. Many companies have begun procurement bidding, and the demand is relatively smooth. Affected by the rising prices of the main industry chain and auxiliary materials, some PV module companies tentatively increased prices, but the transaction volume was not obvious. war situation.

In terms of auxiliary materials, the price of glass remained basically stable this week, and most glass companies mainly executed pre-orders. This week, the mainstream transaction price of glass with a thickness of 3.2mm is about USD4.28/㎡, and the mainstream transaction price of glass with a thickness of 2.0mm is about USD3.329/㎡. Affected by the rising price of raw materials, the profit margin of photovoltaic glass has become smaller at present, and some companies delay the ignition after the furnace is built to wait and see the market trend.

Next week Forecast:

This week, due to strong terminal demand and tight supply and demand of solar silicon, the prices of both solar silicon and solar wafers rose slightly.

However, due to the compressed profit margin of photovoltaic modules, we tried to adjust the price, but the market volume was not obvious. Prices remain stable.

It is expected that the price of photovoltaic modules will continue to be stable next week, but the possibility of a slow increase is not ruled out. It is hoped that customers with projects will stock up as soon as possible to reduce the cost loss caused by the continued price increase.

Following such confusing times, people often find themselves locked up in a dilemma on the decision of installing the appropriate PV module for their homes, offices, etc. And for that very reason, we are here ready to assist you in whatever you need. Contact us now at Whatsapp: +86 159 2091 1832 and get a quote.